Financial advisors from Sensible Advisors attended the NAPFA Spring National Conference in Texas, gaining insights on tax savings, IRAs, long-term care planning, and estate taxes.

IRA

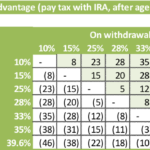

Year-end Tax Planning: Should You Do a Roth Conversion?

Many advisors tout the benefits of a “tax-free income” in retirement for those individuals with a Roth IRA. More important than tax-free income in retirement is the goal of reducing your lifetime tax burden by shifting income from one year to another through a Roth conversion. With the December 31st deadline for 2017 Roth conversions [Learn more…]

Need a Short-term Loan? How About an Interest Free Loan from Yourself?

Intentionally or not, Congress created an opportunity for IRA account holders to get a 0% interest, short-term (60 days or less) IRA loan.

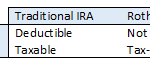

Roth and Traditional IRA contributions: 2 simple rules, and 1 rule that isn’t so simple

If you want to save for retirement in an account or accounts not linked to your job, you have two choices: Traditional IRAs and Roth IRAs. This article gives you guidance about which type you should choose to contribute to. It focuses on the key distinctions between the two types: Contributions to Traditional IRAs are [Learn more…]