Many advisors tout the benefits of a “tax-free income” in retirement for those individuals with a Roth IRA. More important than tax-free income in retirement is the goal of reducing your lifetime tax burden by shifting income from one year to another through a Roth conversion.

With the December 31st deadline for 2017 Roth conversions fast approaching, this article explores why you may want to consider converting a portion of your Traditional IRA balance to a Roth IRA to reduce your lifetime tax burden.

First, it might be worth reviewing the difference between a Traditional IRA and a Roth IRA:

| Features | Traditional IRA | Roth IRA |

|---|---|---|

| Who can contribute? | You can contribute if you or your spouse if filing jointly have taxable compensation and are younger than age 70 ½. | Single tax filers must have Modified Adjusted Gross Income (MAGI) of less than $120k - $135k to fully fund a Roth IRA. Earnings between this range are eligible for a reduced contribution. Married couples who file jointly must have MAGI of less than $189k - $199k to fully fund a Roth IRA. Earnings between this range are eligible for a reduced contribution. |

| Are contributions deductible? | Deductions depend on your income and whether you have a workplace retirement plan available to you. Consult this link for 2017 and 2018 IRA deduction limits. | No, Roth IRA contributions are not eligible for a deduction. |

| Required Minimum Distributions at age 70 ½? | You must start taking distributions when you turn 70 ½ and by December 31st of later years[1] | No, this is not required if you are the original owner of the account. |

| How are withdrawals taxed? | Deductible contributions and earnings are taxed as ordinary income. | Qualified distributions are not subject to tax. |

| Are there penalties for withdrawing money from an IRA prior to age 59 ½? | Unless you qualify for an exception, early withdrawals taken before age 59 ½ are charged an additional 10% tax. | Contributions to a Roth account that have been in the account for at least 5 years can be withdrawn tax and penalty free. Funds that have not been in the account for at least 5 years, or withdrawals of earnings prior to age 59 ½, may be subject to tax and a 10% penalty unless you qualify for an exception. |

Even if you’re not eligible to directly fund a Roth IRA, you may be able to participate by converting all or a portion of your Traditional IRA assets to a Roth IRA.

What is a Roth conversion and who can convert to a Roth IRA?

A Roth conversion is the process by which you transfer funds from a pre-tax Traditional IRA into an after-tax Roth IRA. A Roth conversion requires that you pay ordinary income tax on the amount of the conversion. Once the funds are in the Roth IRA, they grow tax-free and are subject to all the other rules applicable to Roth IRAs.

Unlike Roth contributions, since there are no income limits or earning requirements to convert funds from a Traditional IRA to a Roth IRA anyone can do so.

Whether or not it is advantageous to do a Roth conversion depends on the following:

Your current and future tax brackets

Converting to a Roth IRA is more beneficial the lower your marginal bracket is now, compared to your marginal tax rate in the future. By shifting income from the years when you are in a high tax bracket (later) to when you are in a lower tax bracket (now), you reduce your lifetime tax burden.

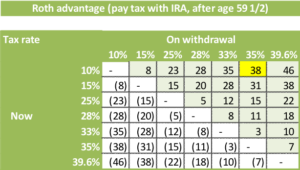

Let’s assume you are 60 years old and currently in the 10% tax bracket. When you eventually withdraw money from your IRA at 71, you expect to be in the 35% bracket. If you have $100 in a Traditional IRA now and earn a 4% return every year until you withdraw the money in 11 years, you’d have $38 more if you had converted your $100 Traditional IRA to a Roth IRA and paid the taxes early (see highlighted cell in table below). That is a 38% improvement just by converting assets to Roth! The table below shows you how much more (less) money you’d have in your Roth IRA if you converted $100 today based on the difference between today’s rate and your future rate. As you can see, the lower your tax bracket is now compared to later, the larger the advantage is of converting to Roth.

If you must pay the taxes on the conversion with funds from your IRA, there is less of an argument to do a Roth conversion. This is because less after-tax money goes into the Roth. The situation is even worse if you are under age 59 ½ and use IRA assets to pay the taxes, as you’d be subject to a 10% early withdrawal penalty.

Whether you have non-retirement assets available to pay the tax on the amount you convert

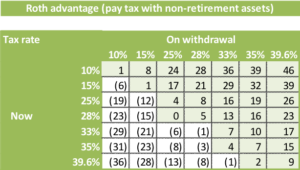

Ideally, you’d pay the tax on the conversion with assets from a non-retirement account. Doing so maintains the current IRA balance and allows tax-free investment growth in the Roth. Using this strategy, illustrated in the table below, you’ll notice that the Roth conversion is advantageous even if the tax rates are the same today as they will be in the future, and, in a few scenarios, there is a Roth advantage even if your tax rate will be lower when you withdraw funds.

Your time horizon and investment return

Longer time horizons allow growth of your investments in a Roth IRA to grow tax-free, whereas Traditional IRA assets only grow tax-deferred. By increasing the time of investment in the examples above, beyond 11 years, the advantage to the Roth is much more pronounced. The Roth advantage is also more pronounced if you receive investment returns higher than the 4% used in the examples above.

Your plans for leaving an estate (bequeathing assets)

Roth IRAs do not have required minimum distributions. If you think you will not fully draw down your IRA balances in retirement, a Roth offers the ability to maintain the tax-free growth in your account. If you think you’ll leave financial assets to your heirs, leaving money in a Roth IRA also allows your heirs to continue receiving tax-free distributions from the account (although they are required to take minimum distributions of the inherited Roth IRA). Money inherited from a Traditional IRA will be taxable as ordinary income to your heirs.

Cash flow considerations

Converting assets from a Traditional IRA to a Roth IRA requires accelerating income and paying additional taxes now. This may put a strain on your cash flow.

Whether you are planning to apply for financial aid around the same time as doing a Roth conversion

By converting assets to Roth, you are realizing additional income in the year in which the conversion is taking place. Colleges use formulas to determine financial aid and look at both assets and income from the parents (as well as the student). It’s important to coordinate your Roth conversions with a college planning expert or accountant to ensure you aren’t disadvantaging or even eliminating your chances of receiving financial aid as a result of doing a Roth conversion.

How much other income you’ll have in retirement

Premiums for Medicare Part B and prescription drug coverage are determined based on your MAGI. Roth IRA withdrawals do not count toward your MAGI, but Traditional IRA withdrawals do. You may be able to reduce your premium outlays in retirement by converting money to a Roth IRA before retirement.

The taxability of your Social Security benefits is also based on your income. The formula is AGI + Nontaxable Interest + ½ of Social Security. Depending on how much income you have, a portion (0%, 50%, or 85%) of your Social Security benefits may be taxed. Withdrawals from Traditional IRAs count towards your AGI, but Roth IRA withdrawals do not.

There is also a 3.8% Medicare surtax that may apply if you have MAGI above $250k for married couples filing jointly or $200k for single filers. Converting to a Roth may push you above this threshold and cause you to incur the additional tax in the year of the conversion.

Converting too much to a Roth may reduce your future tax rates (and make a Roth conversion less attractive than at first glance!), as you will have less future taxable income.

Whether you have plans to move from one state to another

If you are planning to move to another state in retirement, you should consider the state income tax rates of your current and future state. You may be able to reduce your taxes if you time a Roth conversion in a year when you’re in the state with lower state taxes. Suppose for example that you are currently living in Massachusetts (5.1% rate) and plan to move to Florida (0% rate) in the near future. Assuming your other income will be the same regardless of where you are living, doing the Roth conversion while you are living in Massachusetts costs you an additional 5.1% in taxes vs. waiting until you move to Florida.

In summary

A Roth conversion may have substantial advantages over keeping the money in a Traditional IRA unless you expect to face lower tax rates in the future or must pay the tax on the conversion with IRA assets prior to age 59 ½. In addition, the Roth’s greater flexibility may make it advantageous even if you expect future tax rates to be the same, or even a little higher. Unfortunately, the considerations outlined above may conflict with each other for your situation. It can be difficult to assess all the ways that converting assets might affect your lifetime financial plan.

Due to the complex nature of the conversions, if you think it might be advantageous and are seriously considering a Roth conversion, we recommend that you contact your advisor who can help you figure out if a conversion is right for you.

Josh Trubow is a Financial Advisor and CERTIFIED FINANCIAL PLANNERTM at Sensible Financial. To speak with Josh or another member of our team about your financial future, contact us today.