This is Part 1, of 7-part series, read the other parts here: Part 1, Part 2, Part 3, Part 4, Part 5, Part 6, Part 7.

This article is the first in a series on Medicare, the Federal government insurance program that provides health care to seniors and people with certain disabilities.

In this article, I provide an overview of Medicare and its component Parts. Future articles will describe various aspects of Medicare in more detail.

Medicare is a health insurance program for those people age 65 and older, under age 65 with certain disabilities, and of all ages with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a kidney transplant).1

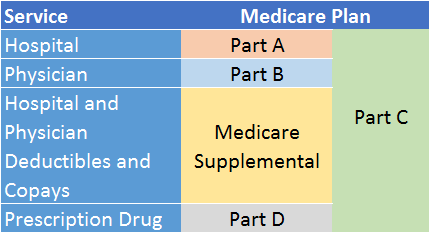

Medicare is composed of several parts (see diagram below for very high level overview):

Part A

Part A covers primarily nursing and hospital costs for those in a hospital or a

Part A covers primarily nursing and hospital costs for those in a hospital or a

skilled nursing facility. In addition to covering nursing services and (semi-private) room charges and meals, Part A may include lab tests and prescription drugs that the hospital administers, medical appliances and supplies, and rehabilitation therapy provided by these facilities. It also covers hospice services for those who have been told by a doctor they have six months or less to live and have chosen palliative care only.

Part A has no premiums. It is already prepaid if you or your spouse (or ex-spouse if you were married for at least 10 years, and you haven’t remarried) has worked for at least 40 quarters during your/their lifetime and paid Medicare tax. Most people enroll in Part A when they turn 65 even if they are still working, and even if they choose to delay signing up for Part B. However, one reason to delay Part A until retirement is if you have a Health Savings Account (HSA) linked to a high-deductible employer health plan that you are allowed to remain on after 65. Starting Part A while still on this health plan would disqualify you from continuing to contribute to your HSA. There is no penalty for delaying Part A.

Part B

Part B covers doctor and mental health expenses (even if provided in a hospital or other nursing facility), as well as diagnostic screenings and lab tests when not administered by a hospital or other nursing facility. Part B also covers:

- Preventive services such as vaccines, mammograms, and diabetes.

- Some medical equipment and supplies.

- Emergency Room visits.

- Some inpatient care (in cases where patients are placed under observation but not formally admitted to a hospital).

- Some prescription drugs (when they are administered in a doctor’s office).

To qualify under Part B, the medical or mental health care must be provided by a health care practitioner who takes Medicare patients – not all do. Medicare Part B covers only 80% of approved expenses. The remainder must be paid either by the patient (out-of-pocket) or by Medicare Supplemental Insurance (more on this later).

Unlike Part A, which is already paid for if you (or your spouse/ex-spouse) has a solid earnings history, Medicare Part B charges a monthly premium. The premium is usually deducted from your Social Security check. If you haven’t yet started receiving Social Security benefits, Part B premiums are billed directly.

There is an enrollment window to sign up for Part B. If you enroll after that window or do not meet one of the exceptions for late enrollment, you will pay a higher premium for your entire life. So, when you turn 65, it is important that you understand the enrollment guidelines, as they will have a significant impact on your lifetime costs for Medicare. (A future article will cover this in greater detail.)

Part D

Part D covers Prescription Drugs that aren’t covered under Part A and Part B.

Confused yet? Here’s how to tell which part of Medicare covers which prescription drugs:

- Part A covers drugs administered when you are a patient in the hospital or a skilled nursing facility.

- Part B covers drugs administered in a doctor’s office, hospital outpatient departments, and in some circumstances, by a hospice or home health care professional (even though most other hospice services are covered under Part A).

- Part D covers outpatient drugs that you administer to yourself, a caregiver administers to you at your home, or you receive if you live in a nursing home. 2

Unlike Parts A and B, which the Federal Government provides, Medicare-approved private insurance companies provide Medicare Part D insurance . Any beneficiary who is eligible for Medicare Parts A and B and permanently resides in a service area of a Medicare Prescription Drug Plan can sign up for Medicare Part D. Part D is optional, but if you don’t enroll in Part D as soon as you are eligible, you might have to pay a late enrollment penalty.3

The pricing scheme for Part D is complex. Most prescription drug plans charge a monthly premium that varies by income and from one insurance company to another. The higher your income, the higher your premium.

Once you actually buy medications, you are subject to a four-phase reimbursement schedule. I will review details of this reimbursement schedule in a future article due to its complexity. You’ve undoubtedly heard of the infamous “doughnut hole” of coverage (or lack thereof)? Yup! This is where the tasty treat resides. Just when your eyes start to “glaze” over (pardon the pun), the amount you are reimbursed also depends on how (and whether or not) your particular medication is classified in the plan’s “formulary,” a list of drugs that each Part D insurance plan decides to cover.

It is important to choose the right prescription drug plan for your health care needs and then check it at least yearly to make sure it is still the right plan for you. No plan covers all prescription drugs, and even if your plan covers the medications you take when you sign up, the pricing tier for that drug can change from year to year (or even within a year). It can even be pulled from the formulary altogether. In short, when the formulary changes, your out-of-pocket costs can change.

Medicare Supplemental Insurance

This insurance is often referred to as “Medigap” insurance. Medigap is optional insurance that covers the 20% of Medicare-approved expenses that Part B doesn’t cover. It also covers Part A and Part B deductibles. There are actually ten different Medigap plans to choose from, ironically each designated by its own letter (don’t ask me why they can’t use numbers, or colors, or even signs of the Zodiac!). Each Medigap plan has a different set and scope of benefits, and a different premium. It is up to each person considering this insurance to determine which plan is most appropriate for him or her. This can be a daunting task.4

Some employers offer a “Retiree Health Plan”. This is basically Medigap insurance (and sometimes Part D Prescription Drug coverage) at a discounted rate. The lifetime costs savings with retiree health plans can be substantial, although some plans are being watered down for younger employees due to cost-saving measures.

Part C (Medicare Advantage Plans)

Medicare Advantage plans are health plans that Medicare-approved private insurance companies administer. The Medicare system (a Federal government program) pays each Medicare Advantage plan a monthly amount for each participant’s health care, regardless of how much health care a person actually receives. By law, these plans must offer the same coverage (at a minimum) that traditional Medicare plans do. Some offer additional services. Medicare Advantage plans offer both HMO- and PPO-type arrangements. Many plans, though not all, also include Part D prescription drug coverage.

If you enroll in Part C, you cannot also enroll in Part A and Part B (traditional Medicare) and (optionally) Medicare Supplemental insurance. It’s either “A-B-Medigap” or “C” You can switch from A-B-Medigap to C, or vice versa, albeit with some potential but important restrictions. In the case where Medicare Advantage also covers prescription drugs, it is either “A-B-Medigap-D” or “C”. You can switch from “A-B-Medigap-D” to “C”, or vice versa, albeit with some potential but important restrictions. So, although your initial choice is not set in stone, you must think carefully about your decision (and timing) to switch.

Medicare Advantage plans have their own premiums, deductibles, and co-pays, separate from (and in place of) traditional Medicare. People often choose Medicare Advantage over traditional Medicare because out-of-pocket costs tend to be lower with these plans. However, it is important to consider many other factors, including choice of doctors (often fewer than with traditional Medicare), quality of care, benefits offered, and geographic availability of plans. Also, there are many more Medicare Advantage plans available in populated areas than in rural communities.

That’s the alphabet soup of Medicare in a cup-sized serving. In future articles, I will provide more detail about the various parts, the costs involved, and when you should enroll. Importantly, some members of Congress have proposed changes to the Medicare program. If these changes appear to make progress toward passage, I will provide updates on them as well.

Footnotes:

1 Centers for Medicare & Medicaid Services, https://www.cms.gov/Medicare/Medicare.html.

2 Medicare for Dummies, by Patricia Barry, AARP Medicare expert, AARP, 2nd Edition; p. 31

4 Sensible Financial does not advise clients on which Medicare Supplemental Plan to choose. This is a personal decision based on your particular health care needs and pre-existing conditions. A Medicare specialist is your best source for this type of advice.