A hundred dollars invested with reinvested dividends into the S&P 500 on January 1, 1926, would have grown to approximately $1.48 million after 98 years, boasting a compounded annual growth rate of 10.3%. (Monthly data provided by Dimensional Fund Advisors.) However, despite the remarkable returns, investors encountered 20 significant market downturns over the past century, leading many to panic and sell at a loss. While stocks historically offer favorable returns, this article underscores their inherent risk and volatility, emphasizing the need for a long-term investment strategy that fits your risk tolerance and capacity. By understanding the historical performance and risks of the S&P 500, you can be better prepared to make rational investment decisions.

The S&P 500 since 1926

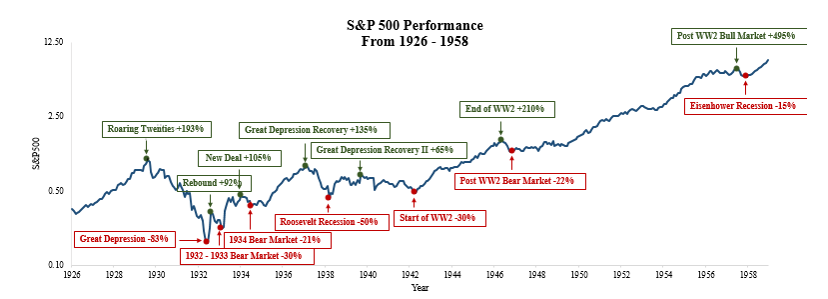

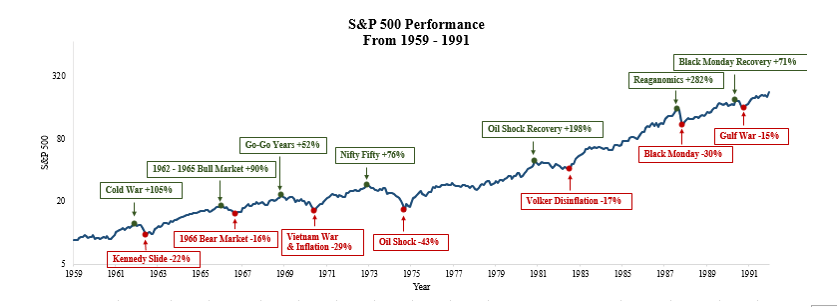

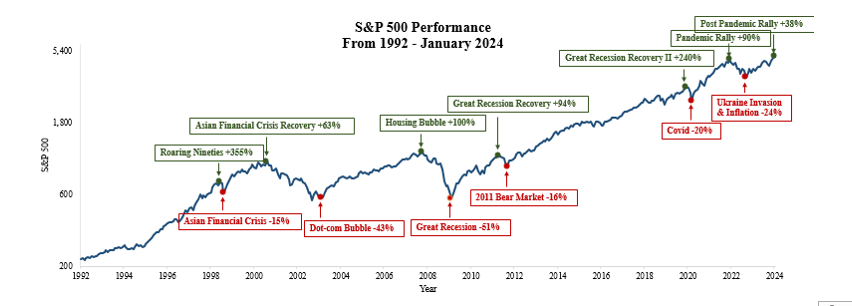

I’ve created three line charts in 32-year increments depicting the bull and bear markets to illustrate the performance and percentage changes of the S&P 500 since 1926. (I’ve used a logarithmic scale to display percentage changes.) To capture the most volatile market events, I have used a plus or minus 15% total returns criterion from trough to peak and peak to trough to categorize bull and bear markets.

Our analysis begins in 1926 amidst the Roaring Twenties bull market, followed by the most significant stock market decline of the century during the Great Depression when the S&P 500 plummeted over 83% at a time with widespread bank failures and high unemployment. The Great Depression was a very severe bear market. An S&P 500 investor at its previous high on 8/31/1929 would have experienced negative returns for over 15 years until 1/31/1945, near the end of WW2. Despite the initial decline of 30% at the start of WW2, the S&P 500 surged by 210% as victory in WW2 became more likely. Post-WW2 and the Great Depression, the S&P 500 experienced its most significant bull market of the past century, growing by 495% from 1947 to 1957. The S&P 500 compound annual growth rate from 1926 to 1958 was 9.23%.

During the emerging Cold War from 1957 to 1961, the S&P 500 increased by 105% as the economy was experiencing heightened government spending amid U.S.-Soviet geopolitical tension. However, by 1962, corporate profits were lower, and the S&P 500 had fallen by 22% during the Kennedy Slide. Subsequent periods are the Go-Go years, the Vietnam War, and the Nifty Fifty boom, where growth stocks like IBM and Polaroid surged. During the Vietnam War and oil price shocks from the OPEC oil embargo, the S&P 500 declined by 29% and 43%, respectively. The market peaked in 1980 amidst 15% inflation, prompting interest rates to hit 19% under Paul Volker, and the S&P 500 fell 17%. The Reaganomic era featured aggressive inflation-fighting and tax cuts, and the S&P 500 increased by 282% from 1982 to 1987. However, the S&P 500 fell 30% during Black Monday in 1987 amidst fears of a stock market bubble, distressed global markets, U.S.-Iran tensions, and computerized trading. The S&P 500 compound annual growth rate from 1959 to 1991 was 9.9%.

The 1990s to the present

Entering the ’90s, the S&P 500 soared by 355% during the Roaring Nineties, a period of rapid economic growth, globalization, and technological innovations. However, by 1998, the Asian Financial Crisis unfolded, triggered by widespread currency devaluations across Asia, leading to a rapid reversal of capital inflows. In the early 2000s, there was a lot of speculation in internet companies, and the S&P 500 plummeted by 43% as the dot-com bubble burst. During the subsequent collapse of the Housing Bubble, there was a widespread default of mortgage-backed securities, and the S&P 500 fell by 51%. Investments made at the peak of the Dot-com and Housing Bubbles would have yielded negative returns for 6.2 and 4.4 years, respectively. From 2011 to 2019, the S&P 500 saw a prolonged bull market, rising 240% during a low inflation and interest rate period, until the COVID-19 bear market with a 20% decline in the S&P 500 over three months. The Federal Reserve quickly lowered interest rates to nearly 0% and injected trillions of dollars of economic stimulus, and the S&P 500 rose 90% during the pandemic rally. The S&P 500 fell 24% in 2022 when Russia invaded Ukraine, and the Federal Reserve started raising interest rates because of inflation. The S&P 500 compound annual growth rate from 1992 through December 2023 was 10.07%.

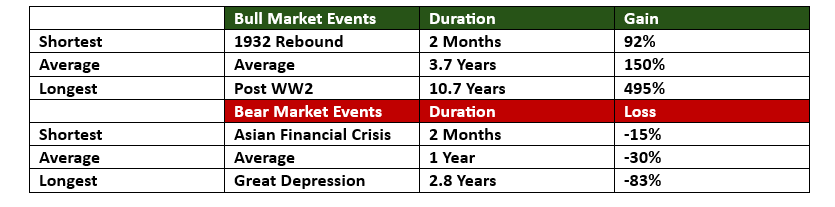

The shortest bull market was the 1932 Rebound, which lasted two months as the S&P 500 gained 92%. On average, S&P 500 bull markets lasted for 3.7 years and had a 150% gain. Post WW2, the largest bull market lasted 10.7 years, and the S&P 500 gained 495%. The shortest bear market was the Asian Financial Crisis, which lasted two months, and the S&P 500 lost 15%. On average, the S&P 500 bear markets lasted 1 year and lost 30%. The Great Depression was the largest bear market, lasting 2.8 years from its peak to trough, and the S&P 500 lost 83%. Over the past century, a wide range of bull and bear markets has occurred. Bull markets ranged from 92% to 495% gains, lasting from two months to over ten years. Bear markets ranged from -15% to -83% losses and lasted two months to 2.8 years. The wide ranges in bull and bear markets suggest that it’s impossible to know precisely when a bull or bear market will end and how severe it will be.

Your risk tolerance and the market

Over the past century, the U.S. stock market has experienced 21 bull markets and 20 bear markets. Our analysis shows that the stock market is highly volatile and has fluctuated considerably over time. Impatient investors may not reap the full reward for the risk they are assuming. For example, an S&P 500 investor who sold at a market trough over the past century would have missed a 150% gain from the average following bull market. At Sensible, we suggest investment strategies that fit clients’ risk tolerance and capacity. It is essential to identify a return and risk combination that you’re comfortable with because it will allow you to be patient and enjoy the fruits of bull markets when and if they arrive, while helping to protect you against losses that you cannot afford.

Disclosures:

This article uses only U.S. stock market data and does not represent global stock markets. The U.S. has experienced a prosperous economy over the last century, becoming a world power and winning two world wars. Therefore, U.S. stock market data over the previous century shows success biases. Past performance does not predict future results but offers valuable insights and lessons into past market trends and behaviors.

Photo by Hans Eiskonen on Unsplash