Whether your taxes are simple or complex, it might be wise to hire an accountant to do your taxes and get the most out of your money.

What’s the difference between Restricted Stock Units (RSUs) & Restricted Stock Awards (RSAs)?

Both RSAs and RSUs are employer plans designed to reward and retain employees by offering additional compensation in the form of company stock. This article will help you understand the key differences between the plans and learn about potential tax saving strategies.

The new year is in full swing. Know your limits and get ready to file!

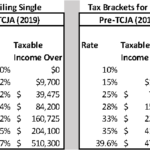

A brief tax guide and update for 2019 As you might have heard in the news recently, the Tax Cuts and Jobs Act (TCJA) was passed at the end of 2017 and many taxpayers are now filing their first return under the new tax regime. The TCJA was enacted with four goals: tax relief for [Learn more…]

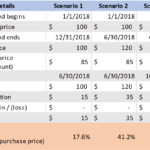

Employee Stock Purchase Plans (ESPPs): Understanding and maximizing a great employer benefit you may be missing out on

In this installment of my series on employee benefits, I will cover employee stock purchase plans (ESPPs), which offer the ability to purchase employer stock through payroll deductions. Only about 30% of eligible participants take advantage of these plans, and on average, those who don’t participate miss out on over $3,000 per year[1]. You might [Learn more…]

A Sensible Approach to Scheduling

At Sensible Financial, we strive to make it easier for you to work with us. We know that scheduling meetings and phone calls has been a major pain point, requiring a lot of telephone and email back and forth. We are pleased to announce that we have upgraded our old-school methods to Calendly, a user-friendly [Learn more…]

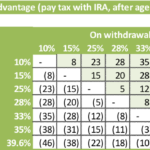

Year-end Tax Planning: Should You Do a Roth Conversion?

Many advisors tout the benefits of a “tax-free income” in retirement for those individuals with a Roth IRA. More important than tax-free income in retirement is the goal of reducing your lifetime tax burden by shifting income from one year to another through a Roth conversion. With the December 31st deadline for 2017 Roth conversions [Learn more…]

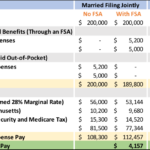

Flexible Spending Accounts: A Useful Employee Benefit That Can Reduce Your Taxes

In my last newsletter article, I looked at how to save for medical expenses using a health savings account (HSA). In this companion article, I’ll focus on another type of savings account called a flexible spending account. These plans are designed to help employees save for certain qualified expenses using pre-tax dollars. Although you may [Learn more…]