In this series, I will discuss the various charitable giving strategies. In this article, I will explain how charitable giving can reduce your tax bill.

Charitable giving can reduce taxes

Charitable donations reduce taxes by reducing taxable income either by lowering total income or by increasing deductions. You can also save on capital gains tax by donating appreciated stock from certain types of accounts. Charitable deductions are limited to a percentage of your adjusted gross income, based on the type of your donation. Taxpayers can carry disallowed deductions forward 5 years. In a future article, we’ll cover how to reduce gross income through charitable donations.

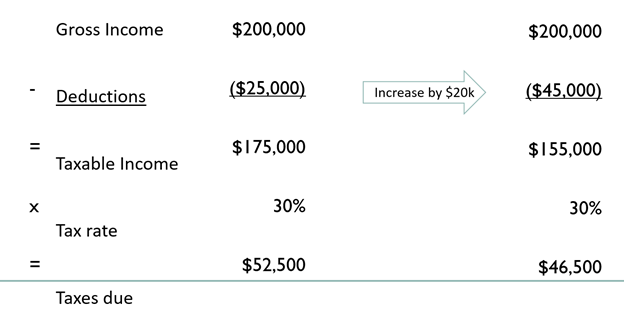

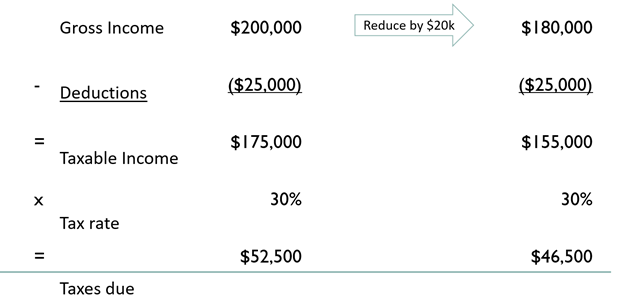

For this example, an individual has gross income of $200k, takes deductions of $25k, and is subject to a 30% tax rate. Reducing their gross income by $20k or increasing deductions by the same amount decreases taxable income and the associated tax liability.

Increasing deductions reduces taxes due

Lowering gross income reduces taxes due

Donating cash

Many people make charitable gifts in cash. This is particularly convenient for small gifts for both the donor and the donee.

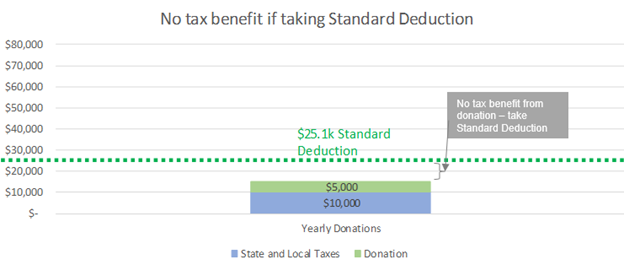

Cash donations can reduce your taxes by increasing your itemized deductions. In general (as illustrated in the chart above), the larger your deductions, the lower your tax liability. Therefore, when you file your taxes, you take the larger of the standard deduction or total itemized deductions. Common itemized deductions include out-of-pocket medical expenses over a percentage of income, state and local taxes (capped at $10k), mortgage interest, and gifts to charity.

Suppose you file married filing jointly with $10k in state and local taxes (SALT), $10k in mortgage interest, $5k in deductible medical expenses, and $5k in charitable donations. In this case, you would itemize deductions as your total itemized deductions of $30k exceed the standard deduction of $25k. Your charitable donation provided you with an additional $5k deduction compared to the standard deduction.

However, if your itemized deductions only include a $5k donation and $10k in state and local taxes, you would take the standard deduction. The $25k standard deduction is greater than the $15k in total itemized deductions. In this case, your $5k donation did not provide any tax benefit. Donating $0 would result in the same tax liability as you would have still taken the standard deduction. With $10k in non-charitable itemized deductions, you would have to donate more than $15k to receive a tax benefit.

Charitable donations only begin to reduce your taxes due once your itemized deductions exceed the standard deduction. However, if you do not itemize there are strategies that may help you to receive a tax benefit from your donation. I’ll delve into that in my next article.

Donating appreciated assets

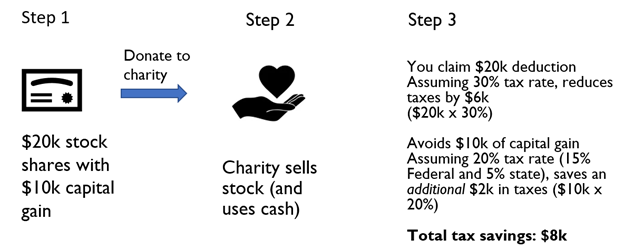

There is another way charitable giving can reduce your tax liability. In addition to the potential charitable deduction, gifting appreciated securities allows you to avoid any capital gains tax you would otherwise owe on the donated security. Therefore, if you have appreciated stock in a taxable brokerage account, it may be more efficient to donate shares instead of cash.

For example, donating $20k in stock with $10k in capital gains allows a tax deduction. It also eliminates the capital gains tax liability of $2k (assuming 20% tax on capital gains). However, this is only applicable for stock donations from brokerage accounts. You can read more about the benefits of giving highly appreciated securities here.

While donating securities may reduce your taxes, it can also pose a burden to smaller charities who are not set up to handle stock donations. Fortunately, there are vehicles that make donating securities easier for charities.

My next article will introduce charitable giving vehicles that facilitate donations of highly appreciated assets. I will also introduce strategies that allow you to receive a tax benefit from your charitable giving if you do not have appreciated securities and take the standard deduction.

The information in this article is not intended as tax advice. Sensible Financial does not provide accounting or tax services. You should consult your tax professional before making any decisions.

“charitable-giving-lg” by KSRE Photo is licensed under CC BY 2.0