Figuring out how to pay for a child’s college education is a daunting task for many families. From 1990 to 2022, college tuition and fees have increased 415% or, on average, 5.26% per year. To minimize expensive student loans, it’s important to develop a savings plan. A popular account to save for education is the 529 savings plan.

What is the 529 Plan?

A 529 college savings plan is a special type of tax-advantaged investment account. Parents or other family members make contributions which grow, tax-free, subject to certain rules. While 529s were originally limited to postsecondary education costs, recent changes to legislation in 2017 and 2019 enabled the plans to cover K-12 education and apprenticeship programs. 529 plans now cover qualified expenses for accredited colleges, universities, vocational or technical schools, and private, religious, or public primary or secondary schools. While anyone can open this type of account, they are typically opened by parents or grandparents on behalf of a child, grandchild, or other family member. Non-owners can also make contributions to the account.

For an accredited college, university, or vocational or technical school, there are no limits to the amount you can contribute to the account each year. However, there are potential gift taxes and total contribution caps to consider when funding an account.

Possible gift taxes and contribution limits

- The IRS may impose a tax on large gifts, and a contribution to a 529 plan is considered a gift to the beneficiary, even if the donor and the account owner are the same person.

- Annual contributions below the annual gift tax exclusion ($17,000 per person or $34,000 per couple per beneficiary) are exempt from federal gift tax.

- You can also contribute up to $85,000 (or $170,000 per couple) as if you had contributed over a 5-year period. For information about gifting considerations please contact your advisor. Some states place a cap on the total amount you can contribute per beneficiary, ranging from $235k to $525k.

- 529 plan contributions may provide tax deductions or credits in over 30 states.

- Many require you to contribute to your home state’s 529 plan to qualify for state income tax benefit.

- Arizona, Arkansas, Kansas, Minnesota, Missouri, Montana, and Pennsylvania offer state income tax breaks for contributions to any 529 plan.

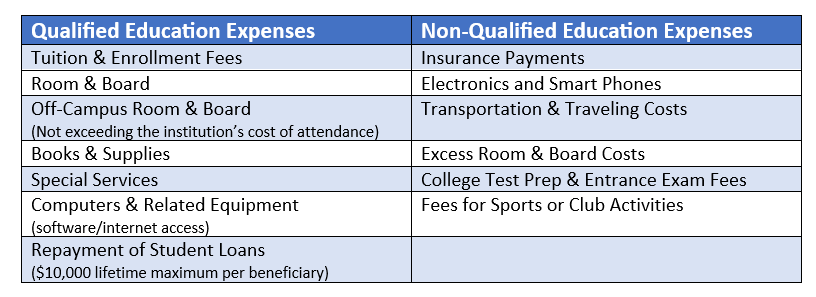

- If recipients use funds from their 529s for qualified education expenses, those withdrawals are exempt from federal and state taxes. If they use the funds for non-qualified distributions, the earnings portion is subject to a 10% withdrawal penalty. Also, there’s a withdrawal limit of $10,000 per year per beneficiary for eligible private, religious, or public primary or secondary schools.

The Two Types of 529 Plans:

There are two types of 529 plans to choose from, Education Savings and Prepaid Tuition Plans.

Education Savings Plans:

An education savings plan is an investment account for qualified education expenses, like tuition, fees, and room and board. These plans are much more popular than prepaid tuition plans due to their flexibility. Generally, beneficiaries can use withdrawals from these plans at any eligible institution of higher education. All education savings plans are state sponsored, and only a few have residency requirements for the custodian and beneficiary.

Remember, the education savings plan is an investment account and has the potential for both gains and losses.

Fees: Education savings plans may charge an enrollment/application fee, annual account maintenance fees, and ongoing program management and asset management fees. The exact amount depends on the state sponsor.

Prepaid Tuition Plans:

These plans allow the custodian of the account to purchase units or credits at participating colleges and universities for future tuition and mandatory feeds at current prices. However, due to inflexibility with school choices, limitations on eligible expenses, and less control over contributions made to the plan, these plans are far less popular than education savings plans. In fact, according to the Investment Company Institute, savings plans held $453 billion in assets, while prepaid plans only held $27.8 billion.

What if My Child/Grandchild Receives a Scholarship?

This is a common question. First, never be too quick to change the plan as you may be unaware of the 529 plan’s flexibility. If the beneficiary receives a scholarship for their undergraduate studies, they can also use the funds for graduate or vocational programs.

If the beneficiary does not use the funds, the owner can change the beneficiary of the account to another eligible family member who may have not received a scholarship. Additionally, you can use 529 plans to pay off student loans. If some beneficiaries don’t need the funds in their 529 account, you can transfer $10,000 out of each plan to pay back the student loans of another family member.

If there are no more educational needs in the family, and you want to take the money out of the plan, you can take out the scholarship amount from the plan with no penalty as long as it’s the principal portion. However, the earnings portion from the initial investment may be subject to income tax and a 10% federal income tax penalty.

If you have children, grandchildren, nieces, or nephews and want more information regarding 529 accounts, please reach out to your advisor. Sensible Financial is happy to answer any questions or make time for a meeting to discuss your financial situation to see if a 529 plan is right for you.

Photo by Robert Bye on Unsplash